To answer this question we conducted a “cost of living” study using seven on-line cost of living calculators. The calculators were provided by the following websites:

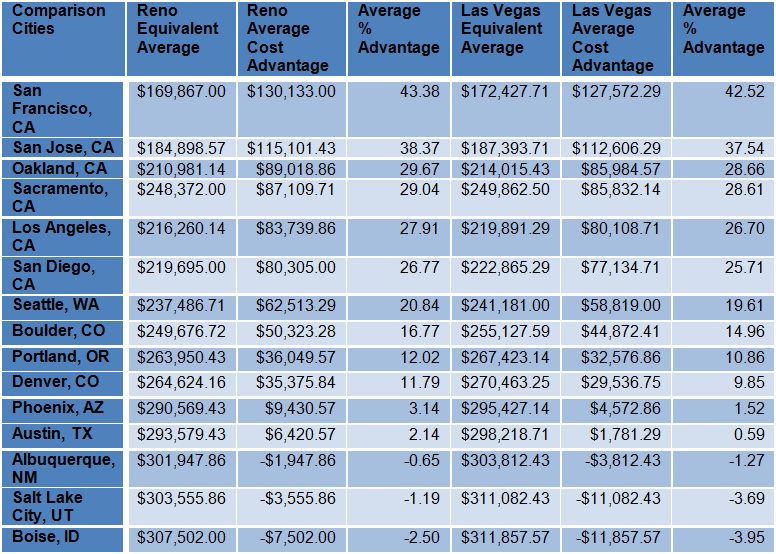

We compared a $300,000 income in 15 selected western cities to the two largest cities in Nevada; Reno and Las Vegas. We then averaged the equivalent incomes. The results of the study are provided below:

Cost of Living Comparison

Reno and Las Vegas are less expensive to live in than most of the cities we examined. Not surprisingly, the cost of living in the San Francisco Bay Area was the highest. Reno and Las Vegas are 43% cheaper to live in than San Francisco, 38% cheaper than San Jose and about 29% cheaper than Oakland. These are huge cost advantages.

For example, if you make $300,000 living in San Francisco, you only need to make $170,000 in Reno or $172,000 in Las Vegas to have the same standard of living. Put another way, you can make $130,000 less in Reno and $128,000 less in Las Vegas and still have the same standard of living. The cost of living is likely even lower in the smaller cities and towns in Nevada.

The Nevada cost of living advantage was between 26% and 29% for the other California cities we researched (Sacramento, Los Angeles and San Diego). For the Pacific Northwest cities of Seattle, WA and Portland, OR, the cost of living advantage came in at about 20% and 11%, respectively. Nevada has a 15 to 17 percent advantage over Boulder, CO and a 10 to 12 percent advantage over Denver, CO. Nevada’s cost of living advantage was much smaller for Phoenix, AZ and Austin, TX; between about 1 and 3 percent.

The only cities we studied that were less expensive than Nevada were Albuquerque, NM, Salt Lake City, UT and Boise, ID. These cities have relatively small 1 to 4 percent cost advantages over Nevada.

Taxes

To the best of our knowledge, the on-line calculators we used do not factor in state or local taxes. Nevada has no income, capital gains or estate tax. This may provide another cost advantage for Nevada. We will look at the impact of state and local taxes in a future article.

Comparable Salaries

It would also be interesting to see how salaries for similar positions compare in these different locations. We will look at this in a future article.